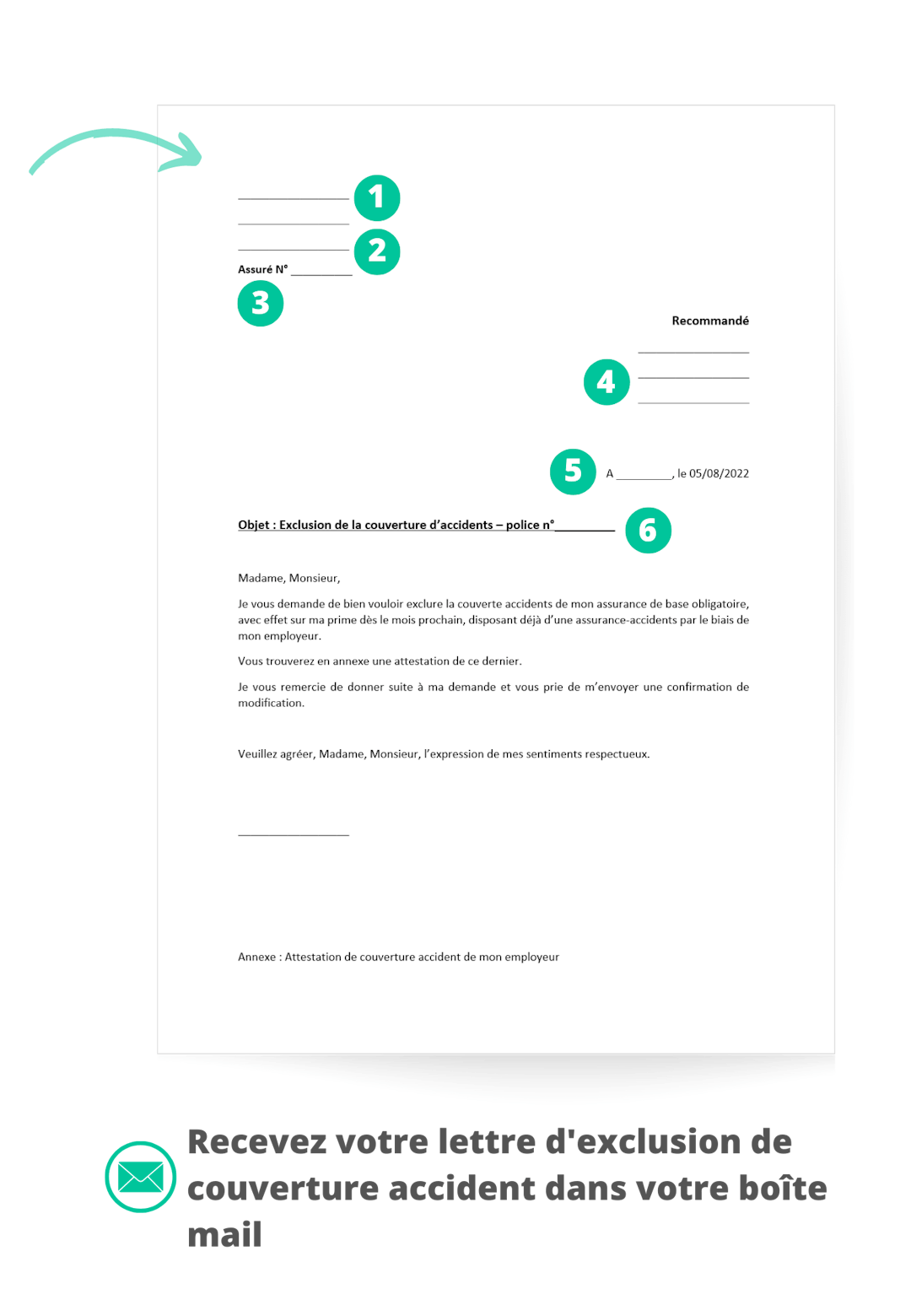

Sample accident coverage exclusion letter

Index

0 min

In the case of a person gainfully employed for more than eight hours a week, accident cover is paid in full by the employer.

What does accident insurance cover?

Accident insurance (or LAA) covers medical expenses related to a occupational or non-occupational accident.

Excluding accident cover can therefore save you an average of 10% on your insurance premiums.

To remember

Please note: In the event that you are no longer insured for accident risk by your employer (in the case of a termination of contract, for example), it is primordial to notify your health insurance company in order to add coverage to your contract.

How can I exclude accident cover from my contract?

If you work more than eight hours a week for the same employer, you are entitled to exclude accident cover from your contract. To do this, simply request a certificate proving that you are insured against the risk of accident from your employer, and then forward it to your health insurer.

Thus, your premium will be reduced from the following month, depending on when the letter is sent.

Good to know

- It's only possible to exclude accident cover from your contract if you work more than 8 hours a week for the same employer.

- The exclusion of your accident cover will be effective on the 1st of the following month

- Excluding your accident cover can save you an average of 10% on your insurance premium.

Updated on: 01.02.2024Written by Alexis MilonHead of health insurance department at Comparea.To learn more about our team click here.