Sample insurance model change letter

Index

0 min

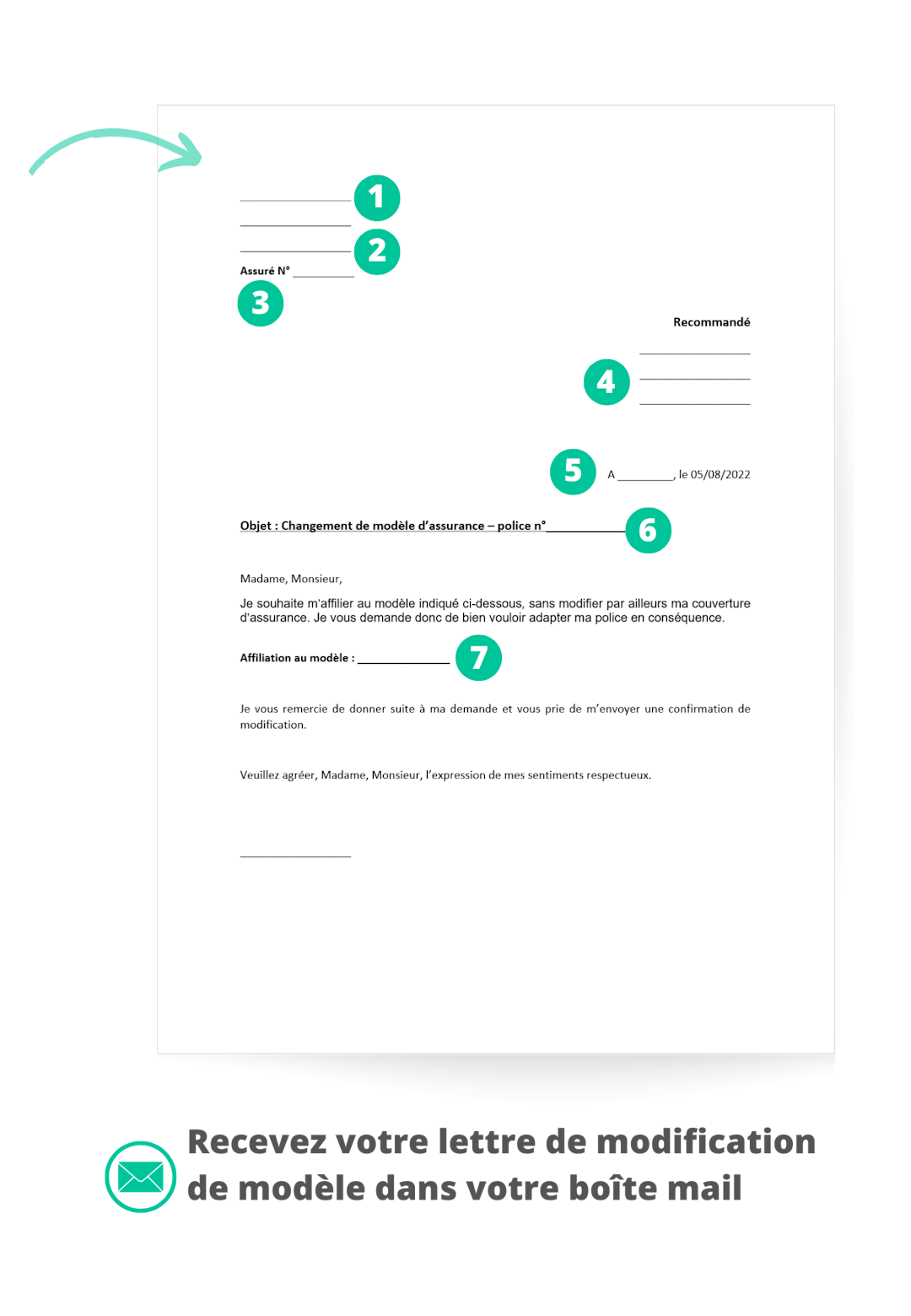

Using our form above, generate your basic insurance model change letter in just a few moments, simplifying the termination process and transition to the model that suits you best. It's fast, intuitive and free!

Optimize your health insurance with COMPAREA

When it comes to modifying or changing your insurance model in Switzerland, whether for your basic or supplementary insurance, it's essential to understand the appropriate procedures and deadlines. Here's a comprehensive guide to help you navigate this process while focusing on terminating your insurance contract.

Which templates are available and which one is right for me?

Every situation is unique in Switzerland. That's why insurance models offer many options to suit your personal needs. You can compare basic and supplementary insurance or follow our recommendations directly on our free comparison site comparea.ch. Also check out our article the different insurance models. We understand that the termination process can seem complicated, but at COMPAREA, we're here to guide you every step of the way, whether it's a termination or a change.

When does it make sense to switch?

Basic insurance

You have the option of customizing your basic insurance to suit your personal preferences. For example, you can opt for a Telmed model instead of the HMO model. Often, this also saves you money on premiums. Another option is to increase your deductible to reduce costs.

Complementary Insurance

Complementary insurance offers you the opportunity to customize your coverage by adding extra benefits or opting for higher coverage. Higher coverage meets higher needs. For example, it can offer you a more comfortable hospital stay or higher contributions for outpatient benefits such as sports practice.

When and how can I change my insurance model?

In the case of an insurance model involving a limited choice of service providers (e.g. HMO, family doctor, prior consultation by telephone), it is possible to change model from one year to the next by sending a written letter to the company towards the end of the year, before November 30 of the current year in order to benefit from an effective date of January 1 of the following year.

Conversely, in the case of a standard basic insurance model, if you wish to change to an insurance model involving a limited choice of benefit providers, the change can be made without delay during the year. If you are currently insured under the standard model (free choice of doctor and CHF 300 deductible), you can also switch to an alternative insurance model up to the 1st of the following month.

Upgrading to a higher level of cover under supplementary insurance is possible, as a general rule, on the 1st of the following month. However, in this case, a new health declaration from you is required. This information is essential for assessing the medical insurance risk. Please note that supplementary insurance is optional for both parties, which means that health insurers may reject applications or exclude coverage for pre-existing illnesses (reserve).

Will my health insurer accept my change of model?

As far as basic health insurance is concerned, as long as you meet the legal deadlines, the health insurer is obliged to accept contract changes, without requiring a health questionnaire. At COMPAREA, we're here to help you understand these processes and choose the best option for your health insurance in Switzerland.

Need more information?

At COMPAREA, we provide you with all the information you need to make informed decisions about your health insurance in Switzerland, whether it's an insurance termination, a change or anything else. Making this kind of choice is crucial, and needs to be carefully thought through. Don't hesitate to contact us for further information on cancelling, changing or any other aspect of your insurance. We're here to help you optimize your coverage while complying with Swiss legal requirements and deadlines. What's more, thanks to our form above, generate your basic insurance model change letter in a matter of moments.

To find out more about cancelling supplementary health insurance in Switzerland, discover our article Cancelling supplementary health insurance Switzerland.

This article in a nutshell? The process for cancelling your supplementary health insurance in Switzerland is similar to that for basic insurance. You need to send a registered letter with acknowledgement of receipt to your current supplementary insurance company, respecting the cancellation deadline. However, it is important to note that unlike basic insurance, where insurers must accept you, it is not compulsory for a new supplementary insurance to do so. Insurers may have reservations based on a previously completed medical questionnaire, which can complicate the process.

The termination letter for supplementary health insurance must include information such as your name, address, policy number, date of birth, desired termination date, and it must be signed manually. The cancellation period depends on the length of your contract, generally from one to three years. You will need to send your termination letter before the specified deadline.

There are several reasons why you may wish to terminate your supplementary insurance, including ordinary termination after the commitment period, in the event of premium increases, unsatisfactory benefits, or moving to another canton. However, it is crucial not to terminate your supplementary insurance without taking out a new policy tailored to your needs, as there is a risk that you will subsequently be uninsured. We recommend that you compare supplementary insurance offers, select the best one for you, complete the application formalities and wait for confirmation of enrolment before cancelling your current supplementary insurance. Be sure to send your termination letter by registered mail with acknowledgement of receipt, and to respect the termination deadlines specific to your health insurance company. If you have any doubts, consult your health insurer's general terms and conditions or contact their customer service department.

Updated on: 01.02.2024Written by Alexis MilonHead of health insurance department at Comparea.To learn more about our team click here.