Loss of earnings insurance comparison

Index

0 min

What is disability insurance?

Disability insurance protects you against loss of earnings due to illness or accident. Its purpose is to cover loss of earnings up to the limit of the benefits subscribed. The purpose of disability insurance is to cover your expenses so that you can maintain a normal standard of living.

In the event that you fall ill or are the victim of an accident, which may result in partial or total incapacity to carry out your professional activity, disability insurance will cover your salary by up to 60% to 70% of your remuneration.

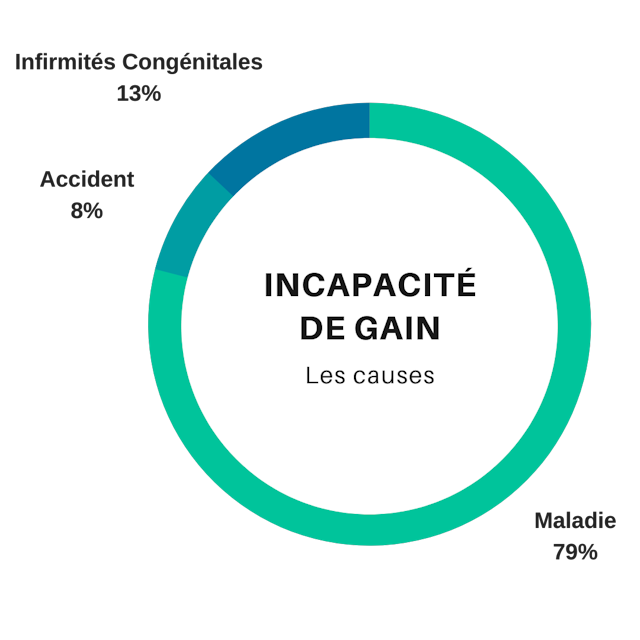

What are the main causes of earning incapacity?

After studying your case, benefits are paid monthly or quarterly, depending on the fund, once the waiting period has been completed. This period varies and depends on the benefits subscribed.

Note that disability insurance also covers recurring insurance premiums.

When you take out disability insurance, you can define the amount of income you want, the duration and the waiting period before payment.

How can you save on your disability insurance?

In order to save on your disability insurance, several possibilities are available to you:

- Compare the different loss of earnings insurance offers directly in order to benefit from the best cover at the best price

- Insure only the sickness risk, without the accident risk in order to benefit from reduced premiums

- List your needs beforehand in order to insure only the benefits that are useful to your situation

Who can take out loss of earnings insurance?

Employers can take out loss of earnings insurance for their employees, note that this is not a legal obligation.

A self-employed person or an uninsured employee can also take out loss-of-earnings insurance to cover the risk in the event of accident or illness.

What does my employer cover in the event of loss of earnings?

In the event that the employer does not take out loss-of-earnings insurance, he is obliged to pay his employee a salary in the event of illness, subject to certain conditions, governed by the Bernese scale.

What is the Bernese scale?

| Year of service | Payment of salary |

|---|---|

| During the 1st year of service | 3 weeks |

| During the 2nd year of service | 1 month |

| During the 3rd and 4th years of service | 2 months |

| From the 5th to the 9th year of service service | 3 months |

| From the 10th year of service | 4 months |

| From the 15th year of service | 5 months |

| From the 20th year of service | 6 months |

In the event that you are unable to carry out your professional activity following an accident or illness, you are entitled to receive your salary on the basis of a period determined by Article 324A of the Code of Obligations, subject to the following conditions:

- You have been working for the same employer for more than 3months

- Or your employment contract has been concluded for more than 3months with your employer

If you meet one of the above conditions, your employer will pay your salary in full for three weeks during your first year of service. Thereafter, and depending on the number of years of service, this period is may vary from 1 to 6 months during which your employer is required to pay your salary in full.

Note that after every 5 years of service following the 20th year, an additional month's payment is added.

So, should I take out loss of earnings insurance?

You can choose to take out loss of earnings insurance to ensure your standard of living in the event of illness or accident.

In the following cases, it is recommended that you take out loss of earnings insurance:

- If you are self-employed: In the event of illness or accident, only loss of earnings insurance will be able to cover your salary.

- If you are not gainfully employed: In the event of earning disability, the annuities paid will enable you to make up for your activity.

What are the different options to compare when taking out disability insurance?

In principle, 3 benefit durations are available to you: 365, 730 or 1095 calendar days within a period of 450, 900 or 1350 consecutive days from the start of the inability to work. This period is indexed on January 1 of the following year based on changes in the consumer price index closed on June 30.

Table of waiting period, duration of entitlement to benefits and duration of period :

| Entitlement duration | Period duration | Waiting period (in days) |

|---|---|---|

| 365 calendar days | 450 consecutive days | 10, 14, 21, 30, 60, 90, 120, 150 or 180 |

| 730 calendar days | 900 consecutive days | 10, 14, 21, 30, 60, 90, 120, 150, 180, 270 or 360 |

| 1095 calendar days | 1350 consecutive days | 10, 14, 21, 30, 60, 90, 120, 150, 180, 270, 360 or 730 |

Updated on: 01.02.2024Written by Alexis MilonHead of health insurance department at Comparea.To learn more about our team click here.

Frequently Asked Questions

The monthly amount of loss of earnings insurance is calculated on the basis of the amount of daily benefits and the chosen waiting period.

No, employers are not obliged to take out sickness insurance for their employees.