Cancellation of supplementary health insurance Switzerland

Index

0 min

How do I cancel my supplementary health insurance?

The process for cancelling supplementary health insurance is similar to that for basic insurance. You must send a registered letter with acknowledgement of receipt to your current supplementary insurance company. This letter must reach your insurer before the cancellation deadline.

Note that it can be risky to cancel a supplementary insurance policy before you have been accepted by a new company. This is because, unlike basic health insurance where insurers are obliged to accept you, you are not forced to be accepted when taking out supplementary insurance.

The health insurers may have reservations about your file following a medical questionnaire that you complete in advance. If you are considered "at risk" by the insurer, the latter may issue a reservation regarding your file, in the case, for example, that you have had health worries in the past.

How do I write my complementary health insurance cancellation letter?

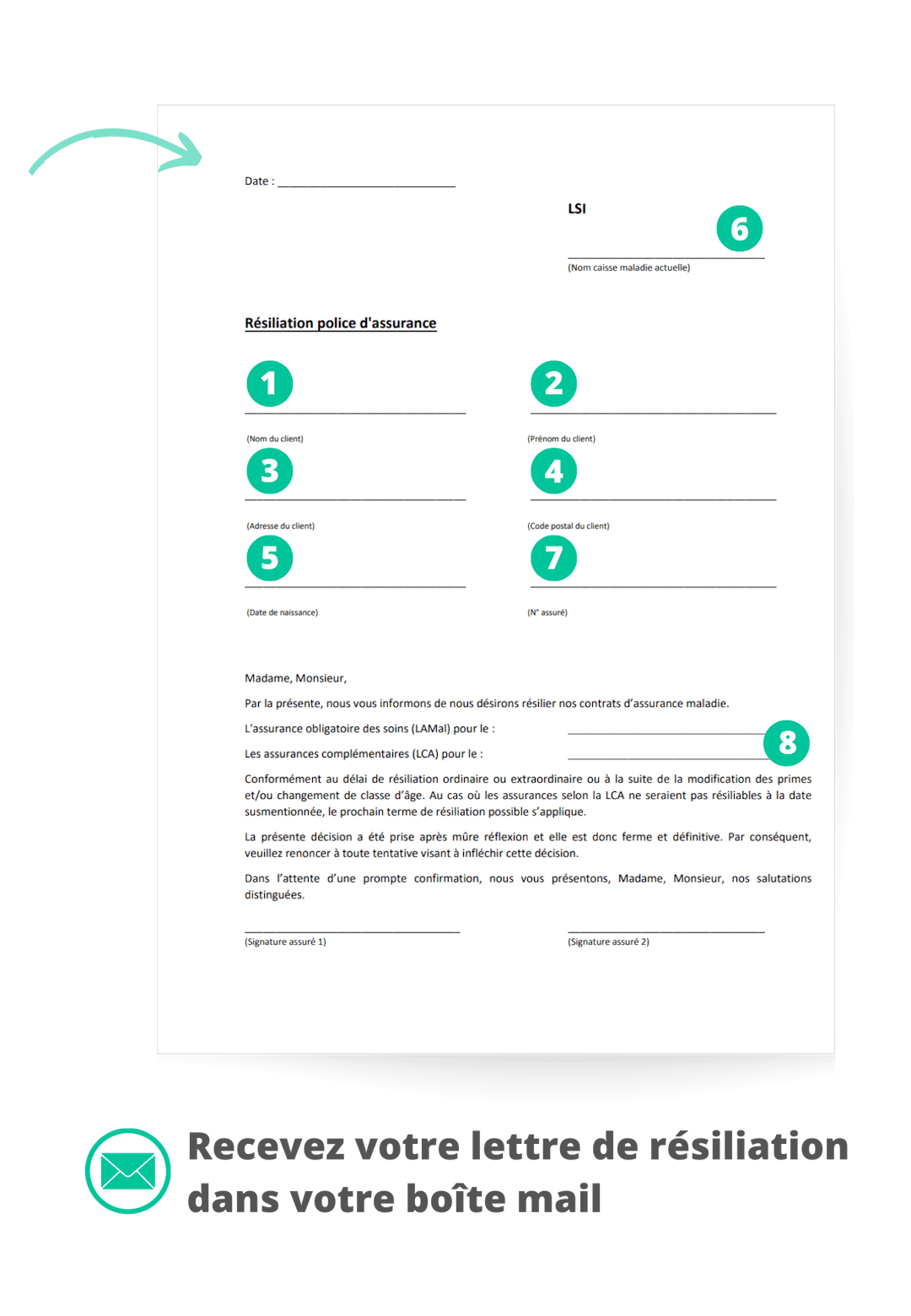

The termination letter for supplementary health insurance is pretty much the same as for basic insurance. You can use our termination letter generator tool above to avoid making any mistakes when drafting it.

In fact, several elements must appear on your cancellation letter:

- Your surname/first name

- Your full address

- Your insurance number

- Your date of birth

- The date on which you wish to cancel your supplementary health insurance

- A handwritten signature

When to cancel my supplementary health insurance?

The vast majority of supplementary health insurance companies apply a minimum contract term. You will find this term on your insurance policy. On average, the commitment period for supplementary insurance is one year. However, some companies apply longer terms, up to 3 years.

In order to cancel your supplementary insurance by December 31, you'll need to send your cancellation letter to your insurer three months in advance, i.e. by September 30.

Please note that these deadlines may vary. If in doubt, don't hesitate to refer to your health insurer's general terms and conditions.

What are the reasons for cancelling my supplementary insurance?

Ordinary termination

Once the commitment period has passed, you are free to terminate your supplementary insurance within the notice period.

Cancellation due to premium increase

If your health insurance company plans to increase your supplementary insurance premiums for the following year, you are free to cancel. Depending on the health insurer, you will need to send your termination letter to the insurer before the end of the current year. Please note that some health insurance companies require termination before the end of November. If in doubt, please consult the general terms and conditions of your supplementary insurance company.

Please note that in order to benefit from the right to cancel due to premium increases, two conditions must be met:

- You must be in the most expensive age bracket of your insurance company.

- You must no longer benefit from the group discount for your supplementary insurance.

Termination in the event of insurance events

In the event that you are not satisfied with a benefit received from your insurance following a claim or reimbursement, you have the option of requesting termination of your contract.

Beware, you will still be required to pay the full supplementary insurance premiums until the end of the contract.

Cancellation if you move to another canton

If your supplementary insurance company can cover you in your new place of residence, you can only cancel within the notice period stipulated in the VVG. The situation is different if your insurance company does not provide supplementary coverage in your new place of residence. In this case, it must terminate the contract. Secondly, you can't be sure that you'll be able to find additional coverage with the same benefits, as each supplementary health insurance company can refuse coverage to anyone it chooses. So, in supplementary insurance, refusal of the application or continued acceptance is always possible.

In the event of health insurance companies refusing you, perseverance will pay off in the end. Submit several applications: Not all caisses have the same examination standards. In the event of a refusal, you can try to contact customer service at any time. Your doctor can also confirm your medical condition in writing. Finally, you can ask for your membership to be maintained at any time for health reasons. You will therefore still benefit from cover, but the caisse will not cover any expenses related to the declared condition.

Cancelling your supplementary insurance without risking becoming uninsured later

At the risk of becoming uninsured, it's vital not to cancel your supplementary insurance without thinking things through properly. If, however, you do wish to cancel your supplementary insurance for good, we recommend that you follow the steps below:

- Compare supplementary insurance offers

- Select the offer best suited to your needs

- Complete the underwriting formalities and health questionnaire

- Wait for confirmation of enrolment (make sure the insurer has no reservations)

- Cancel your current supplementary insurance

What do I need to know before cancelling my supplementary insurance?

- It's best to send your cancellation letter by registered mail, with acknowledgement of receipt.

- The deadline for ordinary cancellation is a minimum of three months. Some health insurance companies apply longer deadlines.

- The commitment period for a supplementary insurance contract is on average one year. Some health insurers apply a longer period, up to three years.

- Before cancelling any supplementary insurance, be sure to take out a new supplementary insurance policy.

- In case of doubt, you can consult your health insurer's general terms and conditions or contact customer service.

Updated on: 01.02.2024Written by Alexis MilonHead of health insurance department at Comparea.To learn more about our team click here.

Frequently Asked Questions

The minimum notice period for ordinary cancellations is three months. Some health insurance companies apply longer notice periods. For example, if you wish to cancel your supplementary insurance by December 31, you will need to send your cancellation to the health insurance company by September 30.

The average commitment period for a supplementary insurance contract is one year. Some health insurers apply a longer period, up to three years.

To cancel your supplementary health insurance, you must send a registered letter with acknowledgement of receipt to your health insurance company at least 3 months before the desired cancellation date.